It is your responsibility to be aware of the applicable laws and regulations of your country of residence. Further information is available in the relevant fund’s offering documents. Top basket holdings are as of the date indicated and may not be representative of the funds current or future investments. Shares of the Trust may not provide the anticipated benefits of diversification from other asset classes.

A fund's Morningstar Rating is a quantitative assessment of a fund's past performance that accounts for both risk and return, with funds earning between 1 and 5 stars. As always, this rating system is designed to be used as a first step in the fund evaluation process. A high rating alone is not sufficient basis upon which to make an investment decision.

- ETFs are subject to market fluctuation and the risks of their underlying investments.

- Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information.

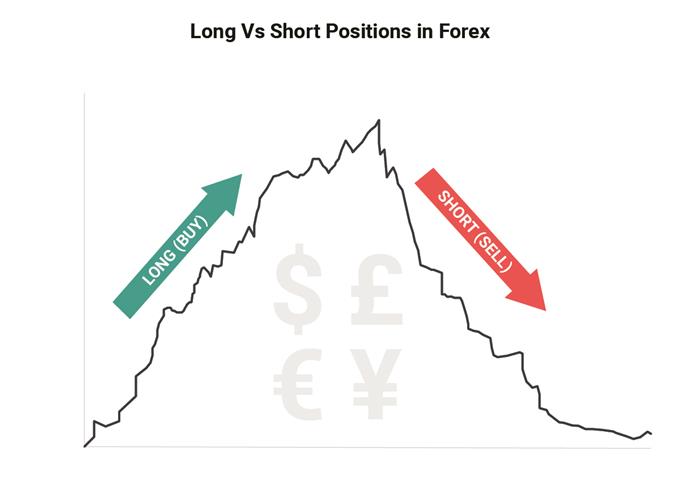

- Here is a look at ETFs that currently offer attractive short selling opportunities.

- The ETF Trends and ETF Database brands have been trusted amongst advisors, institutional investors, and individual investors for a combined 25 years.

Actual after-what exactly is a socialist economy returns depend on the investor's tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401 plans or individual retirement accounts. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares ETF and BlackRock Mutual Fund prospectus pages. This website contains information intended only for financial intermediaries acting as agents on behalf of non-U.S.

Performance

Person” includes, but is not limited to, any natural person resident in the U.S. and any partnership or corporation organized or incorporated under the laws of the U.S. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

The firms are uniquely positioned to aid advisor’s education, adoption, and usage of ETFs, as well as the asset management community’s transition from traditionally analog to digital interactions with the advisor community. The following charts reflect the allocation of GSG's underlying holdings. The following charts reflect the geographic spread of GSG's underlying holdings.

Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice. The iShares S&P GSCI Commodity-Indexed Trust is not an investment company registered under the Investment Company Act of 1940, and therefore is not subject to the same regulatory requirements as mutual funds or ETFs registered under the Investment Company Act of 1940. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Holdings Analysis

Current performance may be higher or lower than the performance data quoted. The investment seeks to track the results of a fully collateralized investment in futures contracts on the S&P GSCI™ Total Return Index. The Trust holds long positions in index futures that have settlement values at expiration based on the level of the S&P GSCI-ER at that time, and earning interest on its non-cash Collateral Assets used to satisfy applicable margin requirements on those index futures positions.

Alger Announces Enduring Growth ETF With ESG Mandate - ETFdb.com

Alger Announces Enduring Growth ETF With ESG Mandate.

Posted: Tue, 07 Mar 2023 08:00:00 GMT [source]

Fidelity does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating ETPs. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from their use. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation and other individual factors and re-evaluate them on a periodic basis.

Top 5 3rd Quarter Trades of FIRST COMMONWEALTH FINANCIAL CORP /PA/

With more than twenty years of experience and a global line-up of 1,250+ ETFs, iShares continues to drive progress for the financial industry. IShares funds are powered by the expert portfolio and risk management of BlackRock. Entities that are pass-throughs for tax purposes have special tax considerations. Pass-through entities may generate unrelated business taxable income that may have undesirable tax consequences for retirement accounts and other tax exempt investors. If you hold units of an investment vehicle taxed as a partnership, you are treated as a partner for tax purposes and will be issues a Schedule K-1 rather than a Form 1099 form for use in filling out your tax return. A K-1 lists the partner's share of income, deductions, credits, and other tax items.

We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. The iShares S&P GSCI Commodity-Indexed Trust is an exchange-traded fund that is based on the S&P GSCI index. The fund uses index futures contracts to gain exposure to a production-weighted index of front-month commodities futures contracts. The adjacent table gives investors an individual Realtime Rating for GSG on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. The "A+ Metric Rated ETF" field, available to ETF Database Pro members, shows the ETF in the Commodities with the highest Metric Realtime Rating for each individual field. To view all of this data, sign up for a free 14-day trial for ETF Database Pro.

Here is a look at ETFs that currently offer attractive short selling opportunities. ETF Database's Financial Advisor Reports are designed as an easy handout for clients to explain the key information on a fund. BlackRock provides compensation in connection with obtaining or using third-party ratings and rankings. Share this fund with your financial planner to find out how it can fit in your portfolio. For standardized performance, please see the Performance section above. Share Class and Benchmark performance displayed in USD, hedged fund benchmark performance is displayed in USD.

The team monitors new filings, new launches and new issuers to make sure we place each new ETF in the appropriate context so Financial Advisors can construct high quality portfolios. To view current and past qualified notices, please refer to the tax documents page here. Visit the 360° Evaluator tool, exclusively for advisors, to analyze investments within a portfolio context in minutes. Learn how key attributes of this fund could factor into your decision-making. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy.

Volatility Analysis

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Independent third-party analytics of the daily holdings shown below can help you compare the ETP's Prospectus Stated Objectives to the characteristics of its underlying holdings. Their use of standardized calculations enable consistent comparison.

The Hypothetical Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted. Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

As a result of money laundering regulations, additional documentation for identification purposes may be required when investing in a fund referred to on this website. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. GSG has a total of 12 holdings and mostly holds assets that track the price of commodities. Although shares of the Trust may be bought or sold on the exchange through any brokerage account, shares of the Trust are not redeemable from the Trust except in one or more blocks of 50,000 units called Baskets. Only institutions that become Authorized Participants may purchase or redeem Baskets.

The lack of an active trading market for the shares may result in losses on your investment at the time of disposition of your shares. The iShares S&P GSCI Commodity-Indexed Trust (the 'Trust') seeks to track the results of a fully collateralized investment in futures contracts on an index composed of a diversified group of commodities futures. The investment objective of the iShares S&P GSCI® Commodity-Indexed Trust (the 'Trust') is to seek investment results that correspond generally to the performance of the S&P GSCI® Total Return Index ('the Index') before payment of the Trust's expenses and liabilities. The Index is intended to reflect the performance of a diversified group of commodities.

Certain sectors and markets perform exceptionally well based on current market conditions and iShares and BlackRock Funds can benefit from that performance. The Trust issues shares representing fractional undivided beneficial interests in its net assets. Please note that, since the shares of the Trust are expected to reflect the price of commodities, as described more fully in the prospectus, held by the Trust, the market price of the shares will be as unpredictable as the price of those commodities have historically been. The price you receive upon the sale of your shares may be less than their NAV. The NAV will fluctuate with changes in the market value of the Trust’s assets, and market supply and demand. IShares unlocks opportunity across markets to meet the evolving needs of investors.

The index reflects the return of the S&P GSCI-ER, together with the return on specified U.S. Treasury securities that are deemed to have been held to collateralize a hypothetical long position in the futures contracts comprising the S&P GSCI™. The price received upon the sale of shares of the Trust, which trade at market price, may be more or less than the value of the commodities represented by them.

The portfolio maintains a sizable cost advantage over competitors, priced within the second-cheapest fee quintile among peers. The Process Pillar is our assessment of how sensible, clearly defined, and repeatable GSG’s performance objective and investment process is for both security selection and portfolio construction. Fidelity receives compensation from the funds advisor or its affiliates in connection with a licensing agreement to utilize Fidelity’s active ETF methodology which may create incentives for FBS to encourage the purchase of certain ETFs.

VettaFi and TMX Group Celebrate at Closing Bell - ETFdb.com

VettaFi and TMX Group Celebrate at Closing Bell.

Posted: Tue, 24 Jan 2023 08:00:00 GMT [source]

It is important to note that they may not https://1investing.in/ ETF Managers' methodology to determine portfolio characteristics in buying and selling securities for the fund. Learn more about the ETF Managers' investment approach and performance in their Prospectus & Reports. Performance is shown on a Net Asset Value basis, with gross income reinvested where applicable.

We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. Morningstar has awarded this fund 2 stars based on its risk-adjusted performance compared to the 100 funds within its Morningstar Commodities Broad Basket Category. ETF Trends and ETF Database , the preeminent digital platforms for ETF news, research, tools, video, webcasts, native content channels, and more. The ETF Trends and ETF Database brands have been trusted amongst advisors, institutional investors, and individual investors for a combined 25 years.